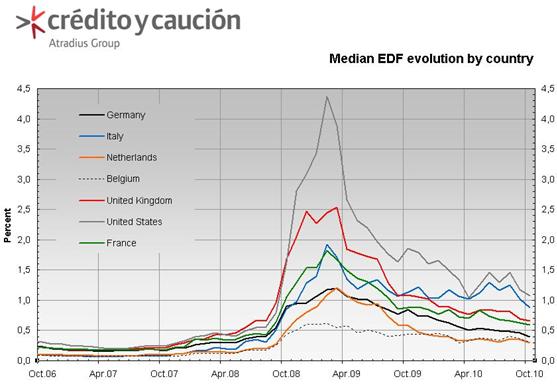

| One of the most important factors that any business needs to know is the trend in insolvencies in their markets. The following Expected Default Frequency [EDF] chart is based on listed companies in the markets referred to, and the likelihood of default across all sectors within the next year. In this context, default is defined as a failure to make a scheduled payment, or the initiation of bankruptcy proceedings. Probability of default is calculated from three factors: market value of a companys assets, its volatility and its current capital structure. As a guide, the probability of one firm in a hundred defaulting on payment is shown as 1%.

Following the previous trend, Crédito y Caución again sees a decrease in EDF in all the economies surveyed. In addition, the median EDF for all those countries dropped to their lowest level for more than two years. Italy recorded the largest decrease [14 basis points], followed by the US [9 basis points], Germany [6 basis points] and Belgium and the Netherlands [5 basis points]. |