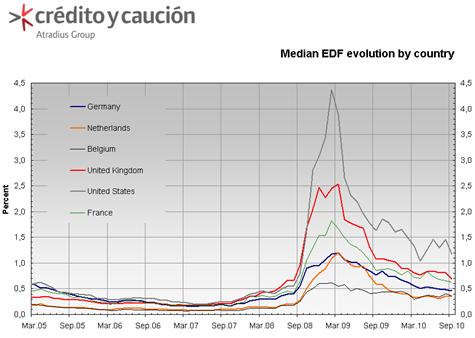

| One of the most important factors that any business needs to know is the trend in insolvencies in their markets. The following Expected Default Frequency chart is based on listed companies in the markets referred to, and the likelihood of default across all sectors within the next year. In this context, default is defined as a failure to make a scheduled payment, or the initiation of bankruptcy proceedings. Probability of default is calculated from three factors: market value of a companys assets, its volatility and its current capital structure. As a guide, the probability of one firm in a hundred defaulting on payment is shown as 1%.  Since the beginning of the year, the EDF values of most of the countries surveyed have shown some volatility from month to month, although the general tendency has been one of overall improvement. After several months of rather inconsistent developments, a simultaneous EDF-decrease in all the economies surveyed was again recorded in September. In addition, the September median EDFs for all the major economies - France, Germany, the United Kingdom and the United States - are the lowest since the September 2008. |